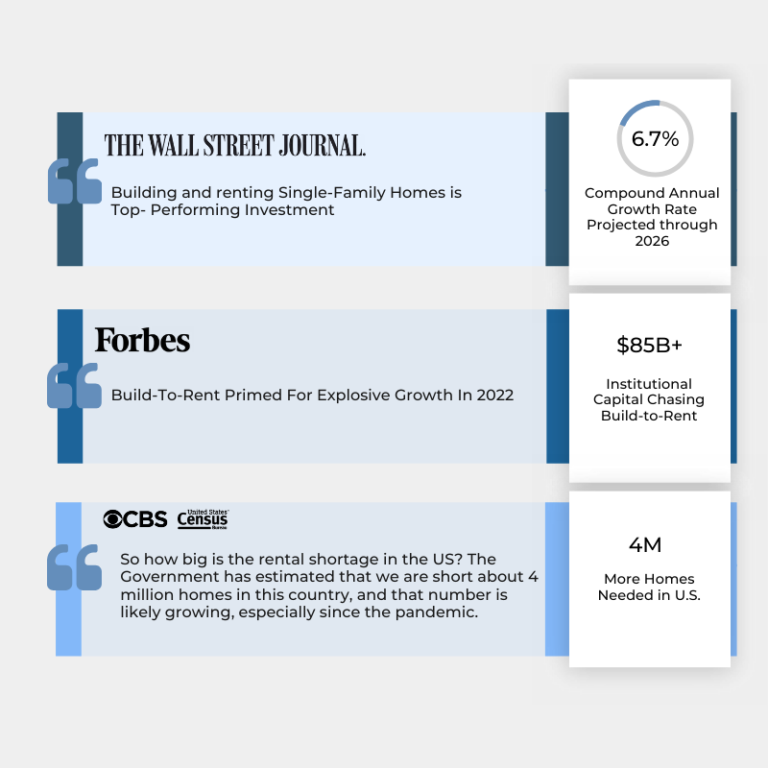

Build-to-Rent assets are expected to produce the highest risk-adjusted return of any property type.

Please read our Offering Circular before investing

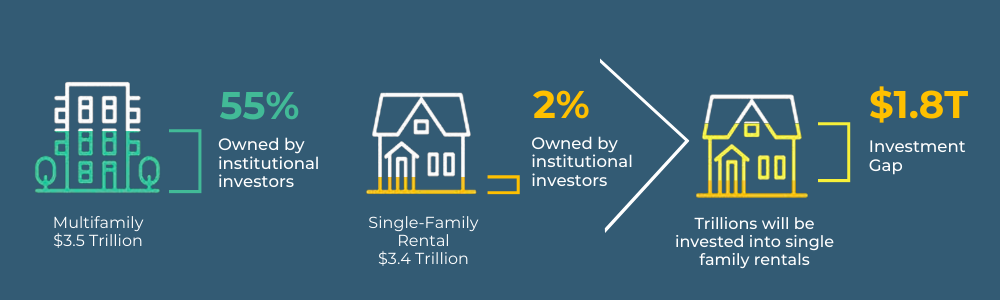

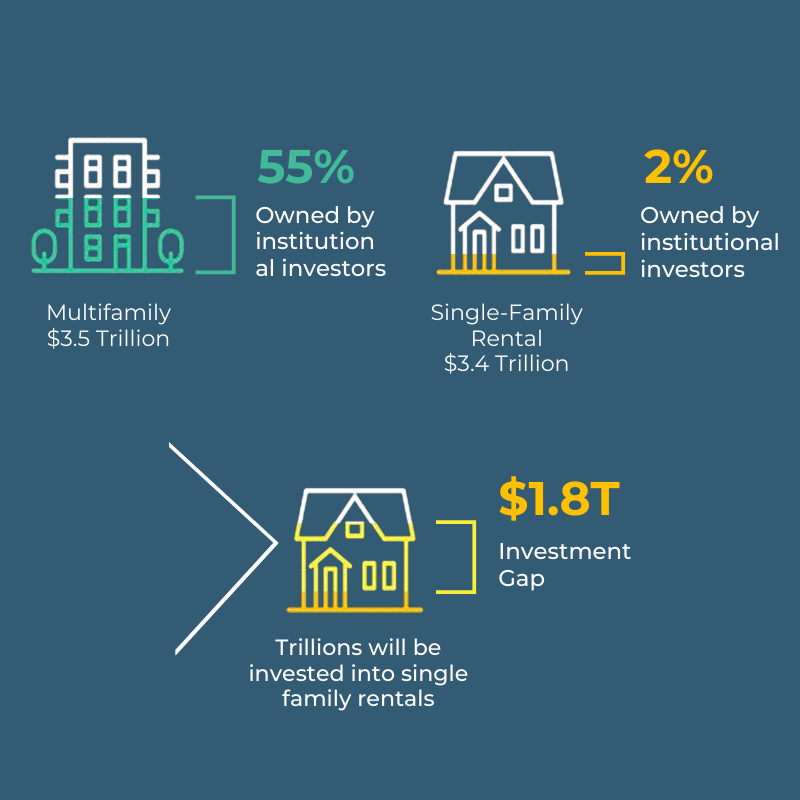

Institutions to invest trillions into single-family rentals over time

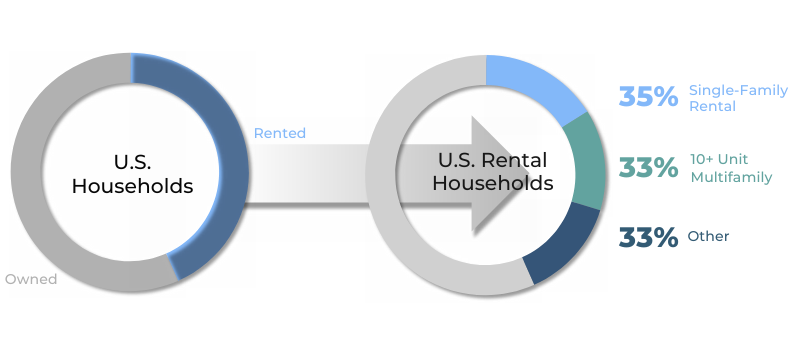

The Build-to-Rent sector represents a massive opportunity for investors, generating better returns than multifamily. While 55% of multifamily rental units are owned by large

institutions, only 2% of single-family rentals are owned by institutions, making this asset class ripe for consolidation.

Please read our Offering Circular before investing

Institutions to invest trillions into single-family rentals over time

We are in for the Long Haul

Between 2018 and 2020, the housing supply shortage increased from 2.5 million to 3.8 million units.

120 consecutive months of year-over-year home price increases, the longest running streak on

record.

72 Million Millennials are entering the market

But from 2018-2020, the

pandemic and other

factors caused a 52%

supply decrease.

In the last year, low supply and high demand have resulted in a 19% price increase.

- Strong And Increasing Demand

- Low Tenant Turnover

- Inflation Hedge

BTR is a great hedge against inflation. Why? As the community is being developed, market rents continue to accelerate. Once constructed, BTR assets immediately lease-up at the market rate. As opposed to other niches with loss-to- lease on their income statements, BTR landlords can raise their rents at a faster rate, leading to outsized risk-adjusted returns.

- Mom-and-Pop Owners

- Recession-Resistant

- Better Cash Flow

- Minimal Capital Expenditures

Build-to-Rent offers significantly lower capital expenditures for the first ten

years of ownership as compared to

existing home portfolios, providing more

free cash flow for investors.

- Margin of Safety

Build-to-rent is the ultimate value-add strategy. BTR homes are constructed at significant discount to market value,

resulting in immediate value creation.

The built-in equity serves the fund with a

nice margin of safety.

- Severe Supply Shortage

- Location Location Location

BUILD-TO-RENT STRATEGY

Build-to-Rent takes the best aspects of single-family rentals and upgrades the experience by developing all homes inside a professionally managed community.

Our strategy will be to develop each project from the ground up (“build”) and then lease and hold (“rent”) the stabilized property for the long-term. Wealth is created during the ground up development phase, and then the asset transitions to delivering a high yield passive income stream. This is a popular strategy utilized by institutions, pension funds, family offices, public REITs and insurance companies to maximize both appreciation and cash flow.

Please read our Offering Circular before investing

> High Yield and Appreciation

> Enter Red Hot Markets at a Better Basis

> Prioritize Location, Location, Location

> Reduce Taxes

> Reduces Cash Drag

> Margin of Safety

PASSIVE INCOME

RECESSION-RESISTANT

BEST RISK-ADJUSTED RETURNS

DIVERSIFICATION

INFLATION HEDGE

SIGNIFICANT TAX BENEFITS

Address

9200 NW 39th Ave., Suite 130 – 1002

Gainesville, FL 32606

(352) 833-5549

info@realstreetcapital.com

Please read our Offering Circular before investing

To present accurate and reliable financial projections, there can be no assurance that any of the assumptions in the projections outlined above will be accurate. The projections are subject to inherent limitations and are based on information available at the time of their preparation. They may be affected by subsequent developments or changes that were not anticipated.

AN OFFERING STATEMENT REGARDING THIS OFFERING HAS BEEN FILED WITH THE SEC. THE SEC HAS QUALIFIED THAT OFFERING STATEMENT WHICH ONLY MEANS THAT REAL STREET BUILD-TO-RENT FUND I, LLC MAY MAKE SALES OF THE SECURITIES DESCRIBED BY THAT OFFERING STATEMENT. NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION IS ENDORSING THE MERITS OF THIS OFFERING OR GUARANTEEING THE ACCURACY OR COMPLETENESS OF THIS OFFERING CIRCULAR.

THE SECURITIES OFFERED BY REAL STREET BUILD-TO-RENT FUND I, LLC ARE HIGHLY SPECULATIVE. INVESTING IN MEMBERSHIP UNITS OF REAL STREET BUILD-TO-RENT FUND I, LLC, INVOLVES SIGNIFICANT RISKS, OR THE POSSIBILITY OF LOSING YOUR ENTIRE INVESTMENT.

PAST PERFORMANCE OF THE COMPANY OR ITS MANAGEMENT DOES NOT GUARANTEE FUTURE RESULTS. SOME OF THE STATEMENTS UNDER “OFFERING SUMMARY”, “RISK FACTORS”, “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS”, “THE COMPANY’S BUSINESS” AND ELSEWHERE IN THE OFFERING CIRCULAR CONSTITUTE FORWARD-LOOKING STATEMENTS. FORWARD-LOOKING STATEMENTS RELATE TO EXPECTATIONS, BELIEFS, PROJECTIONS, FUTURE PLANS AND STRATEGIES,ANTICIPATED EVENTS OR TRENDS AND SIMILAR MATERS THAT ARE NOT HISTORICAL FACTS. IN SOME CASES, YOU CAN IDENTIFY FORWARD-LOOKING STATEMENTS BY SUCH TERMS AS “ANTICIPATE”, “BELIEVE”, “COULD”, “ESTIMATE”, “EXPECT”, “INTEND”, “MAY”, “PLAN”, “POTENTIAL”, “SHOULD”, “WILL”, AND “WOULD” OR THE NEGATIVES OF THESE TERMS OR OTHER COMPARABLE TERMINOLOGY.

YOU SHOULD NOT PLACE UNDUE RELIANCE ON FORWARD-LOOKING STATEMENTS. THE CAUTIONARY STATEMENTS SET FORTH HERE AND IN THE OFFERING CIRCULAR, INCLUDING IN “RISK FACTORS” AND ELSEWHERE, IDENTIFY IMPORTANT FACTORS WHICH YOU SHOULD CONSIDER IN EVALUATING OUR FORWARD-LOOKING STATEMENTS. PROSPECTIVE INVESTORS SHOULD INFORM THEMSELVES AS TO THE LEGAL REQUIREMENTS AND TAX CONSEQUENCES WITHIN THE COUNTRIES OF THEIR CITIZENSHIP, RESIDENCE, DOMICILE AND PLACE OF BUSINESS WITH RESPECT TO THE ACQUISITION, HOLDING OR DISPOSAL OF SECURITIES OF THE TYPE DESCRIBED HEREIN, AND ANY FOREIGN EXCHANGE OR OTHER NON-U.S. RESTRICTIONS THAT MAY BE RELEVANT THERETO.